Introduction

In the fast-paced world of stock trading, intraday strategies can either make or break a portfolio. For those seeking reliable, profitable intraday trading advice, 66unblockedgames.com might not be your conventional resource—but it’s turning heads in finance-savvy circles. As markets become more volatile and competitive, traders increasingly rely on unconventional platforms for sharper insights. Whether you’re a seasoned day trader or just dipping your toes into the world of stock scalping and momentum plays, the guidance you follow can dramatically affect your profit margins.

Profitable intraday trading advice 66unblockedgames.com offers isn’t just about timing your entries and exits. It encapsulates a deeper understanding of patterns, behavioral economics, real-time news analytics, and risk management strategies that maximize returns within a single trading day. Intraday trading, unlike investing, doesn’t wait for long-term value. It exploits minute-to-minute market inefficiencies and liquidity gaps. Hence, having the right tools and strategies, possibly sourced from lesser-known yet valuable websites like 66unblockedgames.com, can be your competitive edge.

With thousands of traders entering and exiting positions each minute, intraday trading can feel chaotic. But with structured, well-researched advice, traders can transform volatility into opportunity. In this comprehensive guide, we dive deep into tactics, risk mitigation, trading psychology, and data-backed setups designed for consistent profitability. The emphasis throughout is on actionable insights — not fluff — tailored for the modern trader who values both performance and precision. Let’s decode what profitable intraday trading looks like and how 66unblockedgames.com contributes to this high-stakes game.

Understanding the Intraday Trading Mindset

Intraday trading demands a unique psychological profile. It’s not for the faint-hearted. You need laser-sharp focus, rapid decision-making skills, and the emotional discipline to cut losses early. The profitable intraday trading advice 66unblockedgames.com offers emphasizes cultivating the right mindset—confidence without arrogance, decisiveness without recklessness. Traders often fail not because of bad strategies but due to emotional sabotage: fear, greed, and indecision. Staying level-headed, especially during volatile market swings, is essential for sustainable profits.

Having a predetermined trading plan helps eliminate emotion from decision-making. Platforms like 66unblockedgames.com encourage users to simulate trades before going live, helping develop pattern recognition and emotional resilience. The site often features gamified trading simulations that test your reaction under pressure—valuable practice for real-world intraday trading. Understanding that each trade is a calculated risk and not a guaranteed win keeps expectations realistic and fosters long-term success.

Key Technical Indicators Every Intraday Trader Should Know

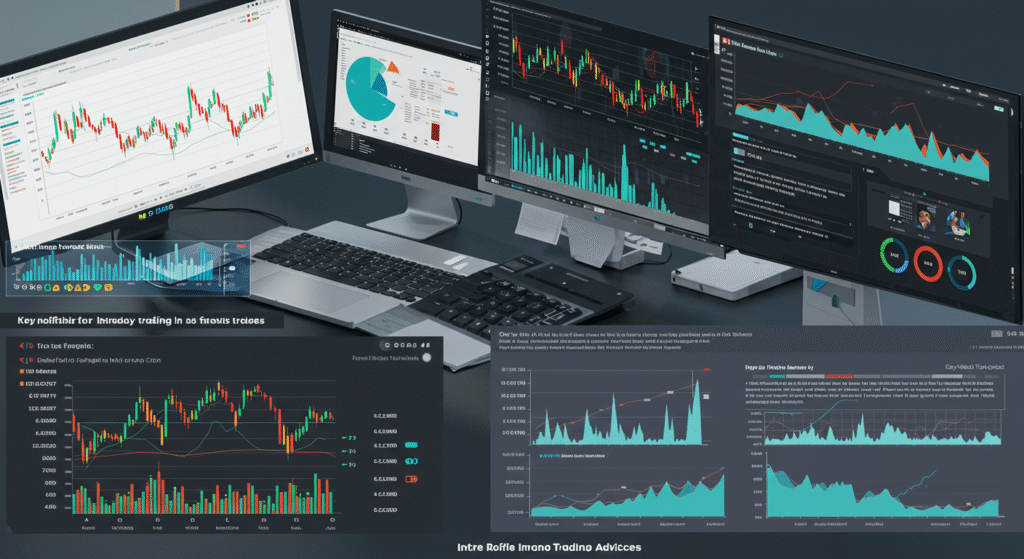

Technical indicators serve as the backbone of any intraday strategy. Whether you’re trading equities, options, or futures, certain tools are essential. The profitable intraday trading advice 66unblockedgames.com compiles includes clear explanations of indicators like Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands. These tools help identify trends, reversals, and volatility—critical data points for scalping or short-term momentum plays.

For instance, RSI can help identify overbought or oversold conditions, signaling potential reversals. When RSI crosses below 30 or above 70, intraday traders often prepare to act. Similarly, using Exponential Moving Averages (EMAs) on 5-minute or 15-minute charts can pinpoint trend direction and crossover signals. On 66unblockedgames.com, interactive tutorials break down these indicators visually, enabling users to test their effectiveness in real-time simulations. Such educational resources make complex tools accessible to traders of all levels.

Crafting the Perfect Intraday Strategy

A winning strategy doesn’t just appear—it’s built, tested, and optimized. One piece of profitable intraday trading advice 66unblockedgames.com stresses is backtesting. Before risking real capital, traders should backtest strategies over historical data to understand potential win/loss ratios. Strategies like opening range breakout, gap and go, or VWAP pullback can be lucrative when applied in the right market context.

Take the VWAP (Volume Weighted Average Price) strategy: it identifies price levels weighted by volume, acting as dynamic support/resistance. A price above VWAP indicates bullish momentum; below suggests bearish sentiment. Layer this with volume spikes or candlestick patterns, and you’ve got a high-probability trade setup. The site includes customizable strategy builders where users input indicators and get feedback based on past market data—adding a layer of confidence before executing trades live.

Risk Management: The Ultimate Game Changer

No trading strategy is complete without a solid risk management plan. The best profitable intraday trading advice 66unblockedgames.com offers repeatedly emphasizes capital preservation over blind aggression. A good rule of thumb is never to risk more than 1-2% of your trading capital on a single trade. This ensures that even a losing streak doesn’t deplete your entire portfolio.

Stop-loss orders are non-negotiable for day traders. They’re your financial seatbelt, preventing emotional decisions from turning a bad trade into a devastating one. Trailing stops can lock in profits during strong trends. The website also recommends using the Risk-Reward Ratio (typically 1:2 or better) before entering trades. By being disciplined with exits, traders can withstand volatility without panic. And since markets are inherently unpredictable, proper risk management is your first and last defense against financial ruin.

Real-Time News: The Edge Few Utilize

Markets move fast—and they react to news even faster. Economic indicators, earnings reports, geopolitical tensions, and Federal Reserve statements can all cause massive intraday swings. According to the profitable intraday trading advice 66unblockedgames.com curates, integrating real-time news alerts into your strategy gives you a vital edge. If you’re not reacting to news, you’re likely reacting too late to price moves caused by others who are.

Sites like 66unblockedgames.com offer browser-based pop-ups and push alerts tied to breaking financial news and high-impact events. This allows traders to anticipate moves or confirm the validity of existing setups. For example, if a stock is breaking out of resistance and a positive earnings report drops simultaneously, that trade has significantly higher conviction. When data meets narrative, smart traders act decisively. And in intraday trading, speed equals profit.

The Role of Volume in Predicting Price Movements

Volume is often the hidden force behind price movement. High volume confirms the strength of a trend, while low volume often signals indecision or false breakouts. One valuable insight from profitable intraday trading advice 66unblockedgames.com is to never ignore volume. It’s not just about price action but the conviction behind that action. A breakout on high volume is more trustworthy than one on low volume.

Volume profile analysis can help determine where institutional players are most active. By plotting volume at specific price levels, traders can see support and resistance more clearly. Combining volume with indicators like OBV (On Balance Volume) or Accumulation/Distribution lines can provide deeper insights. On 66unblockedgames.com, users can simulate these tools with historical data, helping refine timing and accuracy. Understanding how volume aligns with price can be the missing link in many failed intraday strategies.

Using Game Theory and Simulations to Sharpen Skills

One of the more innovative approaches shared in profitable intraday trading advice 66unblockedgames.com is the use of game theory and trading simulations to boost decision-making. Trading is essentially a game of probability, psychology, and timing. By understanding how others might behave—especially in herd-like reactions—you can anticipate market moves more effectively. Game simulations offered on the site put users in realistic scenarios that require quick thinking and strategic adaptation.

Simulations include fake news drops, flash crashes, and algorithmic trading interference, replicating high-pressure environments. This kind of practice improves reaction time and strategic clarity. It’s one thing to learn a strategy on paper; it’s another to execute it confidently in a live setting. The feedback loops embedded in these simulations allow traders to improve with each iteration, reinforcing good habits and eliminating costly ones.

Conclusion: Turning Knowledge into Profits

Profitable intraday trading isn’t just about picking the right stock—it’s about timing, discipline, and strategy. The profitable intraday trading advice 66unblockedgames.com compiles is far more than a novelty—it’s a bridge between theory and execution, offering real tools, simulated practice, and timely insights that make a tangible difference in a trader’s bottom line. Whether it’s technical analysis, news interpretation, or psychological discipline, success in intraday trading comes from combining these pillars into a coherent, tested plan.

Ultimately, the path to profitability lies in preparation and continuous improvement. Markets evolve, and so should you. Embrace technology, explore unconventional learning tools like 66unblockedgames.com, and above all, treat trading as a skill to master—not a gamble. With a solid foundation, strategic foresight, and trusted resources, consistent intraday profits become more than a dream—they become your reality.

Read More: Easy Traveling Cwbiancavoyage