Introduction

When financial emergencies strike, many people turn to quick lending options to cover urgent expenses. One increasingly popular option is payday loans EloanWarehouse, a service designed to provide borrowers with fast access to short-term funds. Unlike traditional bank loans that require lengthy applications, strict credit checks, and long approval times, payday loans offer speed and convenience. Platforms like EloanWarehouse specialize in connecting borrowers with lenders who can provide immediate relief in times of need.

The core idea behind payday loans is simple: they are short-term, small-dollar loans that allow individuals to borrow money until their next paycheck. EloanWarehouse makes this process more streamlined by allowing users to apply online, match with potential lenders, and receive funds directly into their bank account. For many borrowers, this service is a lifeline that prevents late fees, utility shutoffs, or bounced checks. However, as with any financial product, it is important to understand how payday loans work, their advantages, and their potential risks before committing.

This article takes an in-depth look at payday loans through EloanWarehouse, exploring how they function, the eligibility requirements, repayment terms, benefits, and alternatives. By the end, you’ll have the knowledge to make an informed financial decision about whether this type of loan suits your situation.

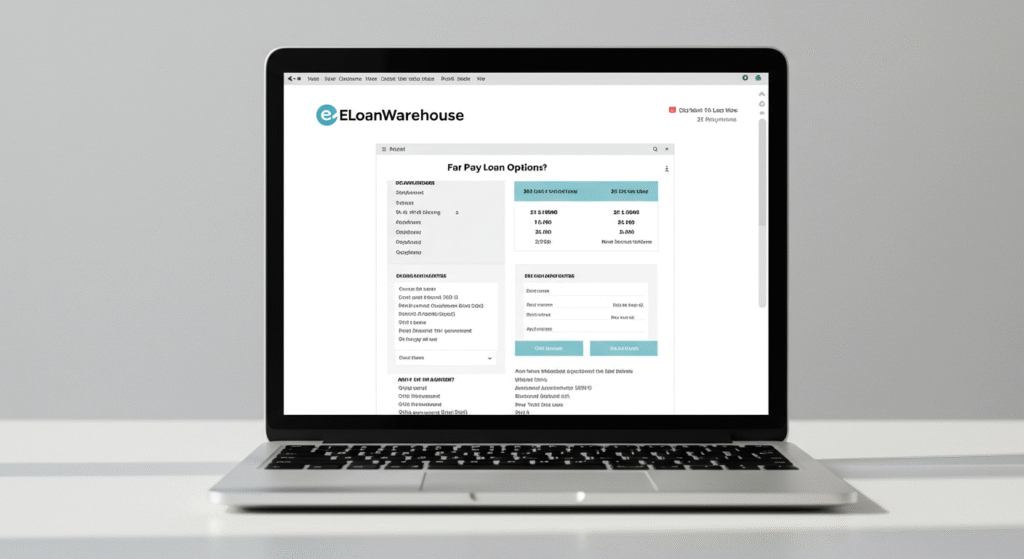

How Payday Loans EloanWarehouse Work

Payday loans EloanWarehouse operate as an online lending marketplace. Borrowers begin by filling out a simple online application with basic personal and financial details. The system then matches applicants with lenders who specialize in short-term loans. Once approved, funds are typically deposited into the borrower’s bank account within 24 hours. This efficiency is one of the biggest reasons why payday loans remain a popular choice for urgent financial needs.

Unlike traditional loans, payday loans are designed for small amounts, often ranging between $100 and $1,000. Repayment is generally due on the borrower’s next payday, which usually means a two-week to one-month term. While this quick turnaround can be helpful for emergencies, it can also pose challenges if a borrower’s financial situation does not improve before repayment is due. Understanding these mechanics is essential before applying.

Eligibility and Application Process

Applying for payday loans through EloanWarehouse is relatively straightforward. Most lenders require borrowers to be at least 18 years old, have a valid checking account, and provide proof of income. Unlike banks that heavily weigh credit history, payday lenders often prioritize current employment and the ability to repay. This opens the door for individuals with poor or limited credit history to access much-needed funds.

The online process usually takes only a few minutes. After submitting the application, lenders review the information and provide an offer. Borrowers can then decide whether to accept the terms. Transparency is key here—reading the fine print is crucial, as fees and interest rates can vary significantly between lenders. The flexibility and accessibility of EloanWarehouse make it appealing, but it also requires responsible borrowing.

Benefits of Payday Loans EloanWarehouse

The primary advantage of payday loans EloanWarehouse is speed. When unexpected expenses arise—such as medical bills, car repairs, or urgent home fixes—borrowers can access funds quickly without waiting for a lengthy approval process. This immediacy often prevents further financial complications, such as overdraft charges or late payment penalties.

Another benefit is accessibility. Since payday lenders typically don’t rely heavily on credit scores, borrowers who might otherwise be denied a traditional loan have an option. For many people, this is their only realistic pathway to borrowing money. EloanWarehouse provides an easy-to-navigate platform, making the borrowing process less stressful during already challenging times.

Risks and Considerations

While payday loans offer convenience, they also come with risks. High interest rates are the most significant concern, as annual percentage rates (APRs) can exceed 300%. For borrowers unable to repay on time, this creates a cycle of debt where fees and penalties pile up, often leading to repeated borrowing. Without careful planning, a short-term solution can quickly become a long-term burden.

Borrowers should also consider their repayment capacity. Since the loan is due by the next payday, it reduces available income for that period. For individuals living paycheck to paycheck, this can create additional financial strain. Understanding the true cost of borrowing and budgeting accordingly is critical before applying for a payday loan through EloanWarehouse.

Alternatives to Payday Loans

Before committing to payday loans EloanWarehouse, borrowers should explore alternatives. Credit unions often offer small-dollar loans with lower interest rates and longer repayment periods. Some employers also provide paycheck advances or hardship loans that carry fewer risks. These options can provide relief without the high costs typically associated with payday lending.

Another alternative is negotiating directly with creditors. Utility companies, medical providers, and even landlords sometimes offer payment plans or extensions when requested. By seeking out these arrangements first, borrowers may avoid the need for high-cost loans altogether. While payday loans serve a purpose, they should be considered a last resort rather than the first option.

Responsible Borrowing Tips

If payday loans EloanWarehouse is the chosen route, responsible borrowing is key. Start by borrowing only what you truly need, not the maximum amount available. This minimizes repayment strain and reduces overall costs. Budgeting carefully to ensure repayment funds are set aside is also vital to avoid additional fees.

It’s also wise to use payday loans for genuine emergencies, not discretionary spending. Borrowers should view them as a temporary bridge rather than a long-term solution. By approaching payday loans with caution and responsibility, individuals can benefit from their advantages without falling into the common pitfalls associated with them.

The Role of EloanWarehouse in Modern Lending

EloanWarehouse has positioned itself as a convenient middle ground between traditional lenders and payday loan providers. By offering an online platform that connects borrowers with multiple lenders, it increases the chances of approval while simplifying the process. This model saves time and allows borrowers to compare terms, even if briefly, before committing.

The platform’s emphasis on speed and accessibility reflects the growing demand for digital lending. As more people rely on online financial solutions, services like EloanWarehouse bridge the gap for those who may not qualify for conventional loans but still need immediate assistance. However, it remains the borrower’s responsibility to make informed financial decisions.

Conclusion

Payday loans EloanWarehouse represent both an opportunity and a challenge for borrowers in financial distress. On one hand, they provide quick, accessible funds that can help cover urgent expenses without the red tape of traditional banking. On the other, they carry high costs and risks if not managed responsibly. Understanding the mechanics, benefits, risks, and alternatives is essential before taking this step.

For those who choose this path, the key is cautious, responsible borrowing—only take what you need, read the terms carefully, and have a repayment plan in place. Exploring alternatives such as credit unions, employer advances, or direct negotiations with creditors can also provide safer options. Ultimately, payday loans through EloanWarehouse can serve as a useful financial tool, but only when approached with clarity, responsibility, and foresight.