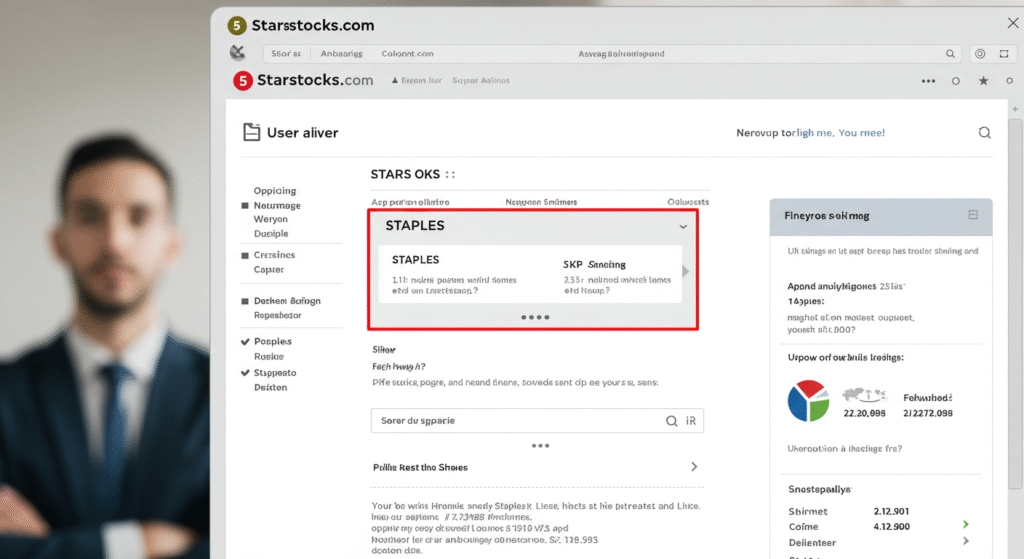

In the fast-paced world of investing, stability is often the key to long-term success. That’s where 5starsstocks.com Staples come in. This category of stocks represents consistent performers—companies that provide essential goods and services regardless of market trends. Whether you’re a seasoned investor or just beginning, understanding the introduction to 5starsstocks.com Staples can be your gateway to building a durable and diversified portfolio.

What Are Staples According to 5starsstocks.com?

The term “staples” refers to consumer staples—products like food, beverages, hygiene items, and household supplies. These are goods people continue to buy even during economic downturns. 5starsstocks.com Staples highlight companies in this sector that maintain high ratings for reliability, performance, and long-term growth.

Why Staples Matter in a Volatile Market

When markets are unpredictable, investors look for safe havens. 5starsstocks.com Staples are typically less volatile because demand for their products remains constant. That’s why understanding this category is crucial in 2025, where market disruptions are more frequent.

5starsstocks.com Staples and Defensive Investing

One of the biggest benefits of staples is their defensive nature. The introduction to 5starsstocks.com Staples includes identifying which companies can weather economic storms and maintain dividends, making them a strategic choice for cautious investors.

Who Should Invest in 5starsstocks.com Staples?

Whether you’re saving for retirement or looking to protect your capital, 5starsstocks.com Staples offer a strong foundation. Beginners benefit from stability, while experienced investors use staples to hedge risk.

The Evaluation Process Behind 5starsstocks.com Staples

The platform doesn’t just list staples; it evaluates them based on performance metrics like ROI, historical stability, dividend history, and consumer demand. This meticulous screening process makes the introduction to 5starsstocks.com Staples both credible and actionable.

Top Rated 5starsstocks.com Staples for 2025

Currently, companies like Procter & Gamble, Coca-Cola, and Johnson & Johnson feature prominently in the 5starsstocks.com Staples list. These companies consistently perform well in both bullish and bearish markets.

Historical Performance of 5starsstocks.com Staples

Looking at the past decade, staples listed on 5starsstocks.com have outperformed more volatile sectors during market downturns. Their resilience makes them indispensable in any portfolio.

5starsstocks.com Staples as Long-Term Investments

The power of compounding and dividend reinvestment makes staples ideal for long-term strategies. A well-diversified selection of 5starsstocks.com Staples can generate both income and growth.

Risk Factors Still Exist

No investment is risk-free. While staples offer protection, they may underperform during bull markets. Understanding this nuance is vital in any introduction to 5starsstocks.com Staples.

Dividend Payouts and Income Streams

One major reason investors flock to staples is their reliable dividend history. Many 5starsstocks.com Staples boast payout ratios that reflect long-term sustainability.

How 5starsstocks.com Ranks Its Staples

5starsstocks.com uses a proprietary 5-star rating system that accounts for volatility, earnings consistency, analyst outlook, and shareholder returns. This method is a crucial part of the introduction to 5starsstocks.com Staples.

Consumer Behavior and Its Influence on Staples

Staples depend on consistent consumer behavior. The demand for essential products rarely fluctuates, making these stocks incredibly predictable. 5starsstocks.com Staples capitalize on these trends.

Integrating Staples into Your Portfolio

Experts suggest allocating 20–30% of your portfolio to staples, especially in uncertain times. Using insights from the introduction to 5starsstocks.com Staples, you can make strategic allocation choices.

Using 5starsstocks.com Tools to Analyze Staples

The platform provides screeners, alerts, and historical charts tailored to staple stocks. These tools enhance user decision-making and make 5starsstocks.com Staples easy to manage and track.

ESG and Ethical Staples

Increasingly, investors are prioritizing ESG (Environmental, Social, Governance) factors. 5starsstocks.com Staples include several companies that align with these ethical investment standards.

International Staples Listed on 5starsstocks.com

While many staples are U.S.-based, 5starsstocks.com also features international players like Nestlé and Unilever. This global perspective broadens the introduction to 5starsstocks.com Staples.

Common Mistakes When Choosing Staples

Investors often confuse consumer staples with discretionary items. This mistake can skew portfolio strategy. A proper introduction to 5starsstocks.com Staples helps avoid this error.

Expert Tips for Maximizing Returns with Staples

Diversify across categories (food, hygiene, medicine), monitor quarterly earnings, and reinvest dividends. These tips elevate your strategy using 5starsstocks.com Staples.

The Future of 5starsstocks.com Staples in 2025 and Beyond

With AI-driven analysis and increased market uncertainty, 5starsstocks.com Staples are poised to gain more relevance. Their reliability and growing popularity make them a stronghold for modern portfolios.

Top Picks and Analysis from 5starsstocks.com Staples

Investing wisely in today’s volatile market starts with a clear understanding of dependable stocks. That’s why this guide focuses on the top picks and analysis from 5starsstocks.com Staples, a leading platform in evaluating consumer staples. These are companies providing essential goods—like food, beverages, and household items—that people rely on regardless of market conditions. By diving into the data and performance trends available on 5starsstocks.com, investors gain clarity on which staples offer the most stable and profitable opportunities in 2025.

Why Investors Trust 5starsstocks.com Staples Top Picks

The value of stability in uncertain economic times cannot be overstated. 5starsstocks.com Staples are trusted by thousands of investors because they highlight stocks that historically outperform during market downturns. These staples provide a solid foundation in any portfolio by maintaining consistent growth and dividends.

The Method Behind 5starsstocks.com Stock Ratings

The platform uses a proprietary 5-star ranking model. This includes a deep analysis of volatility, return on investment, dividend history, earnings growth, and financial strength. The top picks and analysis from 5starsstocks.com Staples are data-driven and designed to minimize risk.

Coca-Cola and Procter & Gamble: Evergreen Staples

Year after year, Coca-Cola and Procter & Gamble remain leading names on the list of top picks and analysis from 5starsstocks.com Staples. Their global brand recognition, stable revenue, and consistent dividend payments make them excellent long-term investments.

The Role of Consumer Behavior in Picking Staples

Consumer staples rely heavily on predictable buying patterns. Items like toothpaste, cleaning products, and packaged food remain in demand even in recessions. This reliable demand is what makes the top picks and analysis from 5starsstocks.com Staples so effective for portfolio protection.

Johnson & Johnson: A Defensive Giant in Staples

Johnson & Johnson is frequently featured in the top picks and analysis from 5starsstocks.com Staples due to its diversified product lines in health and pharmaceuticals. Even in down markets, the company sees steady revenue.

How 5starsstocks.com Separates Staples from Hype

Not all consumer companies are stable. Some rely too heavily on seasonal demand or trending products. The 5starsstocks.com Staples team avoids hype stocks and focuses on companies with at least a decade of financial consistency and low debt-to-equity ratios.

Dividend Performance in the Staples Sector

One key reason investors prefer staples is their dividend stability. Many companies listed in the top picks and analysis from 5starsstocks.com Staples have increased dividends for 10+ years, signaling strong management and steady cash flow.

Walmart and Costco: Retail Staples with Massive Reach

Retail giants like Walmart and Costco are increasingly being highlighted in the top picks and analysis from 5starsstocks.com Staples. These companies dominate the consumer goods landscape with their vast distribution networks and low-cost business models.

Geographic Diversification Among Staples Picks

The best staples are not limited to U.S. markets. Nestlé, Unilever, and Diageo offer international exposure, and all three often appear in the top picks and analysis from 5starsstocks.com Staples. This geographic variety provides stability against localized economic issues.

2025 Market Trends Supporting Staples Growth

Even as tech and AI dominate headlines, the demand for basic goods is steady. Rising inflation and cautious consumer spending make staples a top focus for smart investors using platforms like 5starsstocks.com.

Risk Analysis and Volatility Index for Staples

The 5starsstocks.com Staples section includes a volatility index to guide users. This helps investors understand the trade-off between returns and stability. For those seeking lower volatility, staples rank highest.

Best Dividend Yields Among 5starsstocks.com Staples Picks

Looking for income from your portfolio? The top picks and analysis from 5starsstocks.com Staples often include high-yield options like General Mills and Kimberly-Clark. These companies offer above-average dividend payouts.

Tech-Enabled Tools for Staples Analysis

5starsstocks.com isn’t just a list. It offers advanced tools like real-time screening, earnings alerts, and AI-powered predictions. These features enhance the top picks and analysis from 5starsstocks.com Staples and provide ongoing value for investors.

Avoiding Overexposure to Staples

Diversification is still key. While staples provide stability, experts recommend balancing them with growth and tech stocks. Still, top picks and analysis from 5starsstocks.com Staples ensure that the core of your portfolio remains strong.

ESG Ratings and Ethical Investing in Staples

Modern investors care about sustainability. 5starsstocks.com includes ESG ratings for each staple stock, making it easier to invest with your values. Companies like Unilever and Colgate-Palmolive lead this category.

Long-Term Growth Metrics Used by 5starsstocks.com

To appear in the top picks and analysis from 5starsstocks.com Staples, a company must demonstrate growth over multiple quarters, low debt ratios, and consistent EPS performance. This ensures quality.

Comparing Staples with Other Sectors

Staples are often compared to sectors like healthcare and utilities. However, their consumer-driven nature offers a unique mix of low risk and dependable returns, making the top picks and analysis from 5starsstocks.com Staples highly attractive.

Community Insights and User Ratings

5starsstocks.com allows users to rate and comment on staples. These insights help investors validate top picks and understand market sentiment. It adds a layer of social proof to the top picks and analysis from 5starsstocks.com Staples.

Forecasting the Future of Staples in 2025

As global supply chains stabilize and consumers return to essentials, staple stocks are projected to rise steadily. Experts agree that the top picks and analysis from 5starsstocks.com Staples will be more relevant than ever in the next market cycle.

Building a Profitable Portfolio Using 5starsstocks.com Staples

If you’re looking for long-term growth with minimal risk, building a profitable portfolio using 5starsstocks.com Staples might be the smartest move you make this year. In today’s volatile market, consumer staples are emerging as one of the most reliable sectors for consistent returns. Using 5starsstocks.com as your strategic guide allows you to choose top-rated staples that offer financial security, dividend consistency, and long-term value.

Why 5starsstocks.com Staples Are Essential to Portfolio Building

Consumer staples include everyday products such as food, household items, hygiene goods, and beverages. These products remain in demand even during market downturns. Building a profitable portfolio using 5starsstocks.com Staples provides a safety net for your investments.

The Logic Behind Consumer Staples Investing

These types of stocks are less affected by economic cycles. People will always need toothpaste, detergent, and groceries. That’s why platforms like 5starsstocks.com track their performance closely and why building a profitable portfolio using 5starsstocks.com Staples gives investors an edge.

How 5starsstocks.com Identifies Quality Staples

The site uses a 5-star ranking system based on consistent earnings, strong cash flow, low volatility, and dividend history. Building a profitable portfolio using 5starsstocks.com Staples means relying on this data-driven approach.

Risk Management Through Staple Stocks

Staples tend to move less drastically than tech or energy stocks. Their defensive nature reduces overall portfolio volatility. This makes building a profitable portfolio using 5starsstocks.com Staples a core strategy for risk-averse investors.

Diversification Within the Staples Sector

Don’t limit yourself to just one company. From beverages (Coca-Cola) to hygiene (Colgate) and food (Nestlé), the 5starsstocks.com Staples selection spans many sub-sectors. Diversification ensures broader market coverage and protection.

Dividend Income From Top Staples Picks

Many staples provide steady income through quarterly dividends. If you’re building a profitable portfolio using 5starsstocks.com Staples, you’re also creating a passive income stream that compounds over time.

The Power of Dividend Reinvestment

Platforms like 5starsstocks.com show how reinvesting dividends into top staples boosts returns significantly. That’s why dividend reinvestment is a cornerstone when building a profitable portfolio using 5starsstocks.com Staples.

Portfolio Stability in Economic Uncertainty

In inflationary or recessionary times, staples outperform many sectors. When growth stocks falter, your staples portfolio from 5starsstocks.com remains resilient.

Comparing Staples With Growth Stocks

While growth stocks offer high returns, they carry higher risks. Staples offer a more predictable, consistent path to wealth—especially when building a profitable portfolio using 5starsstocks.com Staples.

International Staples for Global Exposure

5starsstocks.com also includes international staples like Unilever and Diageo. These provide global diversification, which enhances the stability of your holdings when building a profitable portfolio using 5starsstocks.com Staples.

ESG and Sustainable Investing With Staples

Sustainable investing is trending. Staples companies with high ESG scores offer ethical investment opportunities. Platforms like 5starsstocks.com filter these for your benefit.

Portfolio Allocation Tips for Staple Investors

Most advisors suggest allocating 20–40% of your portfolio to staples. This ratio varies based on your risk tolerance. Following this guideline makes building a profitable portfolio using 5starsstocks.com Staples much more efficient.

Smart Rebalancing With 5starsstocks.com Tools

The site offers portfolio monitoring and rebalancing tools to help maintain your asset mix. These features are critical to long-term success when building a profitable portfolio using 5starsstocks.com Staples.

Long-Term Growth Through Compounding

Staples aren’t just defensive—they grow. Companies like Procter & Gamble and Johnson & Johnson have outperformed many sectors over decades. Compounding dividends and returns from staples add up fast.

Real-Time Screening Features on 5starsstocks.com

Advanced tools let you filter staples by volatility, dividend yield, and market cap. This customization makes building a profitable portfolio using 5starsstocks.com Staples tailored to your personal goals.

How Beginners Can Start With Staples

If you’re new to investing, staples are a perfect entry point. Their predictability and strong performance make them ideal for long-term beginners following 5starsstocks.com Staples.

Expert Picks and Market Sentiment

The top 5-star staples on the site are often backed by institutional investors. This alignment gives credibility to the process of building a profitable portfolio using 5starsstocks.com Staples.

Avoiding Common Portfolio Mistakes

One major mistake is overconcentration in one brand or sector. Diversifying your staples and balancing them with other sectors ensures sustainable portfolio health.

Future Outlook for 5starsstocks.com Staples

As inflation continues and markets adjust to global trends, staples will remain essential. Experts predict increasing investor interest in building a profitable portfolio using 5starsstocks.com Staples through 2025 and beyond.

Final Thoughts on Strategic Portfolio Building

If you’re serious about protecting your wealth and achieving steady gains, consider building a profitable portfolio using 5starsstocks.com Staples today. With smart tools, expert ratings, and reliable data, 5starsstocks.com gives you everything you need to succeed.

Read More: Coyyn.com Gig Economy