Introduction

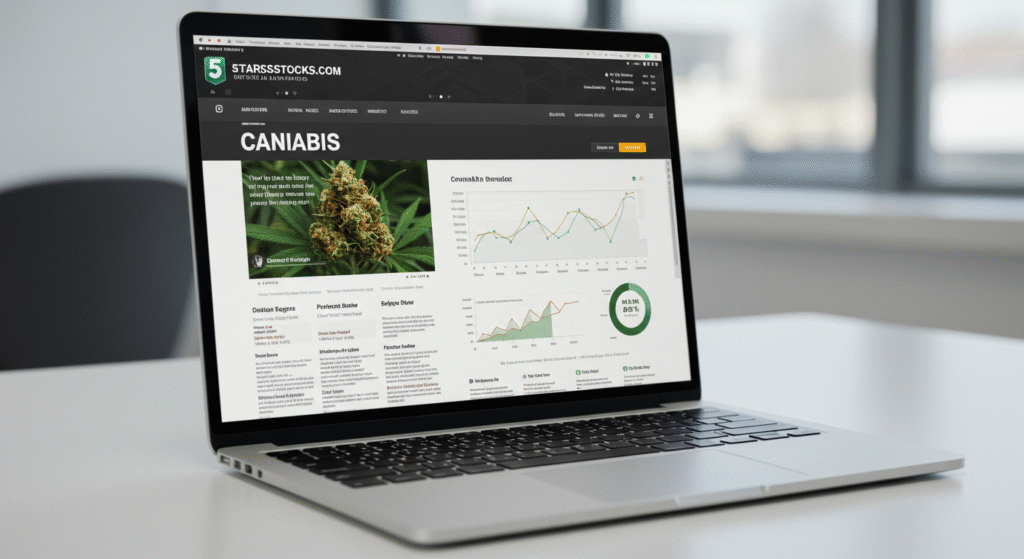

The cannabis industry has rapidly transformed from a fringe market to one of the most talked-about sectors in modern investing. With shifting regulations, evolving consumer trends, and explosive market potential, cannabis stocks have become both a challenge and an opportunity for investors. One resource at the forefront of guiding investors through this green rush is 5starsstocks.com cannabis. This platform is increasingly recognized for offering curated stock picks, up-to-date market analytics, and deep dives into cannabis-related companies.

As more states in the U.S. legalize cannabis for medical and recreational use, investor interest has surged. However, with high volatility and industry-specific risks, making informed decisions is more crucial than ever. That’s where platforms like 5starsstocks.com play a pivotal role. It doesn’t just provide stock names—it delivers comprehensive analysis, growth potential breakdowns, and market trend assessments tailored to the cannabis sector. Whether you’re a retail investor exploring the cannabis space or a seasoned trader seeking new angles, understanding how 5starsstocks.com supports cannabis investing is essential.

In this article, we’ll explore how the platform operates, what kind of cannabis stock insights it offers, and why it stands out in an increasingly crowded field. With a keen focus on real-time data, user-friendly presentation, and expert-backed recommendations, 5starsstocks.com cannabis insights may be the key to gaining a competitive edge in this dynamic industry.

The Rise of Cannabis Investing in America

Cannabis investing has grown tremendously in the last decade, driven by widespread legalization and changing public perception. As of 2025, over 75% of U.S. states have legalized cannabis in some form, whether medicinal or recreational. This legal shift has unlocked massive opportunities in agriculture, pharmaceuticals, retail, and biotech. Cannabis companies, from cultivators like Tilray to biotech firms like GW Pharmaceuticals, are now traded on major exchanges and attracting attention from institutional and retail investors alike.

Yet, with rapid growth comes significant uncertainty. Regulatory developments, competition, and supply chain challenges can affect stock performance overnight. That’s where a platform like 5starsstocks.com cannabis tracker steps in, offering clarity and curated insight amid the market noise. Rather than merely listing cannabis stocks, it analyzes them through the lens of profitability, innovation, and sustainability—critical factors in long-term investing.

Moreover, cannabis is no longer just a story about weed. The industry now spans wellness products, medical research, and consumer goods, making it multifaceted and ripe for portfolio diversification. 5starsstocks.com recognizes this by highlighting not only obvious picks but also emerging under-the-radar companies poised for growth. Their analytical approach allows investors to dig deeper, minimizing risks while optimizing returns.

How 5starsstocks.com Evaluates Cannabis Stocks

Investing in cannabis is not just about jumping on trending tickers—it requires a disciplined evaluation of financials, leadership, market strategy, and legal risk. 5starsstocks.com uses a proprietary rating system to rank cannabis stocks from one to five stars, factoring in key indicators such as price momentum, earnings potential, debt ratios, and competitive positioning.

The site’s cannabis stock evaluation process begins with quantitative screening. Analysts use filters like revenue growth, EBITDA margins, and institutional ownership to narrow down high-potential companies. From there, they apply qualitative factors like management team background, product differentiation, and recent M&A activity to determine long-term viability.

Each featured stock comes with a comprehensive write-up, investor outlook, and comparison with industry peers. For example, a company like Curaleaf might receive a high rating due to strong retail expansion, while a newcomer could earn three stars for innovation but caution due to cash burn. This system empowers investors to make informed decisions backed by structured analysis rather than hype.

Real-Time Cannabis Market Trends and Alerts

One of the strongest features of 5starsstocks.com cannabis insights is its focus on real-time market trends and alerts. The cannabis industry is highly sensitive to policy updates, earnings reports, and supply chain shifts. Missing one development can mean the difference between a profitable trade and a costly misstep. The platform offers email alerts, technical charting, and trend analysis to keep investors ahead of the curve.

For instance, if federal rescheduling discussions emerge or a major cannabis merger is announced, 5starsstocks.com pushes notifications to users immediately. This real-time approach contrasts with traditional investing newsletters that may lag behind fast-moving news cycles. Charts highlight breakout patterns, support and resistance levels, and RSI trends specific to cannabis tickers—tools essential for intraday and swing traders.

Additionally, the platform’s blog provides expert commentary on news impacting cannabis ETFs, Canadian vs. U.S. growers, and international expansion plays. These content updates allow users to stay current without needing to search across multiple platforms. It’s a one-stop hub that balances technical precision with market relevance.

Spotlight on Top-Performing Cannabis Stocks

Each month, 5starsstocks.com features a spotlight on high-performing cannabis stocks, offering in-depth profiles of companies showing notable price action, innovation, or sector leadership. These spotlights are particularly helpful for identifying potential breakout stocks before they hit mainstream attention. The platform reviews each pick’s historical performance, short interest, product pipeline, and strategic direction.

For example, recent spotlights included Green Thumb Industries, noted for its profitability streak, and Verano Holdings, which expanded into new territories with aggressive licensing deals. These reports are supported with charts, earnings analysis, and future price targets based on both technical and fundamental modeling. It’s not just about identifying past winners—it’s about anticipating the next one.

What sets 5starsstocks.com apart is its objectivity. Unlike pump-and-dump newsletters or hype-driven forums, their spotlight pieces maintain a balanced tone, discussing both opportunities and red flags. This transparency builds trust and positions the site as a reliable resource for cannabis investors who value integrity and depth in their research.

Cannabis ETFs and Diversified Investment Approaches

While picking individual cannabis stocks can be lucrative, it also comes with higher risk. That’s why cannabis ETFs and diversified investment strategies are frequently covered on 5starsstocks.com. ETFs like AdvisorShares Pure US Cannabis ETF (MSOS) and Global X Cannabis ETF (POTX) allow investors to spread exposure across the industry without relying on a single company’s performance.

5starsstocks.com provides ETF breakdowns that list top holdings, sector weightings, and rebalancing schedules. They also include performance comparison charts and fee analyses to help investors choose the most efficient fund. For those new to the cannabis space, ETFs can be a smarter entry point—and the platform clearly communicates these pros and cons.

Additionally, the site discusses hybrid strategies such as combining blue-chip cannabis stocks with smaller-cap high-growth plays. These tactical combinations can optimize for both safety and upside. By demystifying diversified cannabis investing, 5starsstocks.com makes the sector more approachable for all investor types.

Risk Factors in Cannabis Investing—and How 5starsstocks.com Helps

Despite its growth potential, cannabis investing carries notable risks—legal uncertainty, taxation issues (like IRS 280E), limited banking access, and product oversupply. Investors must tread carefully. 5starsstocks.com cannabis analysis actively addresses these challenges through risk disclosures, sentiment tracking, and cautionary guidance in its reports.

For example, if a cannabis company faces legal trouble, supply chain bottlenecks, or declining margins, the platform updates its rating and advises caution. Red flag metrics such as declining revenue per dispensary or excessive share dilution are highlighted in their warning section. These risk alerts provide early warning signals and help investors avoid painful losses.

Furthermore, their blog educates users on macro risks like delayed federal legalization, banking reform stagnation, and cross-border trade complications. By equipping investors with both optimism and realism, 5starsstocks.com establishes itself as a balanced guide in a speculative space.

Educational Tools and Resources for Cannabis Investors

Beyond stock picks and alerts, 5starsstocks.com cannabis resources include educational articles, webinars, and glossaries to support learning. For newer investors, understanding terminology—like “multi-state operators (MSOs),” “hemp derivatives,” or “synthetic cannabinoids”—is crucial. The platform breaks down complex ideas into digestible lessons.

Interactive tutorials cover topics such as “How to Read a Cannabis Company’s Financials” and “Understanding Cannabis Licensing and Compliance.” These resources are structured to cater to both retail investors and financial professionals. Additionally, their cannabis investing course provides a step-by-step guide from market entry to portfolio management.

The site’s educational commitment shows that it’s not just about pushing stock tips—it aims to build confident, knowledgeable investors. In a sector where misinformation is rampant, this emphasis on clarity and instruction makes 5starsstocks.com stand out from the crowd.

Conclusion: Why 5starsstocks.com Cannabis Is Worth Your Attention

The cannabis sector is filled with both high promise and high volatility. Navigating it successfully requires more than guesswork or hype—it demands reliable, data-driven insight. 5starsstocks.com cannabis coverage provides exactly that: a sophisticated yet user-friendly platform where investors can research top picks, monitor real-time market trends, assess risks, and learn continually.

Whether you’re curious about the next breakout MSO, exploring cannabis ETFs, or simply seeking trusted analysis in a complicated space, 5starsstocks.com offers the clarity and depth modern investors need. With its structured rating system, timely alerts, educational tools, and unbiased reporting, it equips users with the tools to invest confidently in cannabis.

Now more than ever, as the industry matures and policy shifts loom, having a trusted guide like 5starsstocks.com is not just helpful—it’s essential. For those looking to capitalize on cannabis opportunities while managing risk, this platform may be the competitive advantage you’ve been seeking.

Read More: Profitable Intraday Trading Advice 66unblockedgames.com